Why Does Financial Stability Matter?

Reaching financial stability is the first step to try to reach that first million dollars. Not only that, but it is the first step to financial security and financial freedom. As we briefly mentioned in Life Is A Board Game: Career Path, there are many factors that can affect one’s ability to do this. The U.S. Net Worth Statistics focuses on the following factors: education level, marital status, family structure, homeownership status, region, race/ethnicity, and age. When examining the data, there are a few definitions that we need to go over.

Thank you for reading this post, don't forget to subscribe!

Business-y Definitions

What Is Net Worth?

It is basically what you own minus what you owe. Or in business lingo, it is your assets minus your liabilities. For example, I own $4,000,000 worth of real estate (which I don’t otherwise this would be the shortest blog chronically a financial journey ever), but I also have $3,999,999 worth of debt from my chronic candle purchasing addiction. In this hyperbolic example, my net worth would be the grand total of $1.00.

Median Vs. Averages

When examining net worth, the data focuses on the median instead of the average.

The averages are relatively simple. They are the sum of all of the net worths collected divided by the total number of net worths. For example, if we have four net worths $50, $100, $100, and $1,000 the average net worth would be $312.50.

Medians are something that we do not use as much in everyday life. When examining financial data, however, medians are very important. Let’s look at the previous answer and find the median. The median is the number that is in the middle of the distribution. Since we have four numbers in our example, we find the average of the two middle numbers. Therefore, the median net worth in our example is $100.

As you can see, the median better represents the “average” person and prevents the data from being skewed by significantly high and significantly low numbers.

Averages can be misleading. Keep that in mind when looking at averages. Averages are very useful, but medians can be better to get a perspective on the more common experiences.

Education Level and Financial Stability

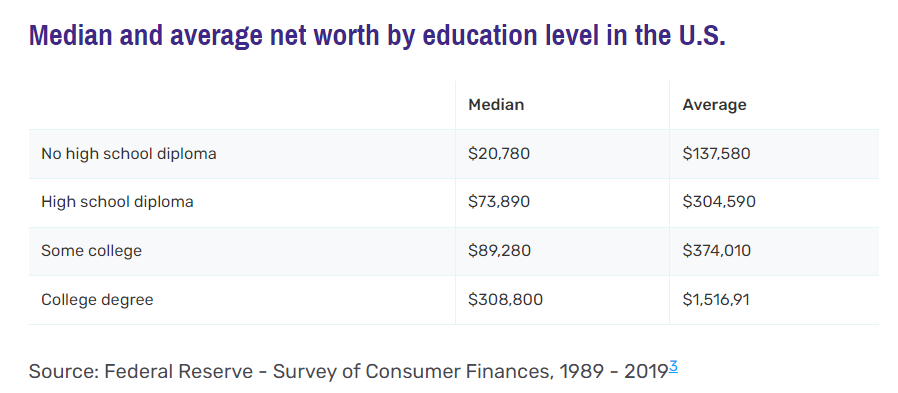

The Federal Reserve started its survey of consumer Finances in 1989. Since the survey started in that year, the median net worth for those without a high school diploma has declined by over 50%. Finishing high school is crucial for future financial success. There are always outliers to every statistic, but the odds will be even more stacked against you without a high school diploma.

It is true that secondary education increases your chances of gaining a higher income. It is also true that every level of college education overwhelmingly comes with debt. 29.1% of those with a college degree have student loans with an average balance of $55,880. After achieving a degree, you are not instantly able to pay off your debt. Depending on your chosen career path and cost of living, making these payments can be difficult. Especially when the amount continues to grow with interest and any accrued late payments. Even if you do not complete your bachelor’s degree, the debt follows you. 25.8% of those with some college have student loans with an average balance of $26,820. It is even worse for those that attempt an associate’s degree. According to the Federal Reserve Report on the Economic Well-Being of U.S. Households in 2018, 37% of borrowers with outstanding student loans who left before completing an associate degree are behind on payments.

But those with a college degree have family wealth almost three and a half times that of those with some college, more than four times those with a high school diploma, and almost 15 times the group without a high school diploma.

Marital Status and Financial Stability

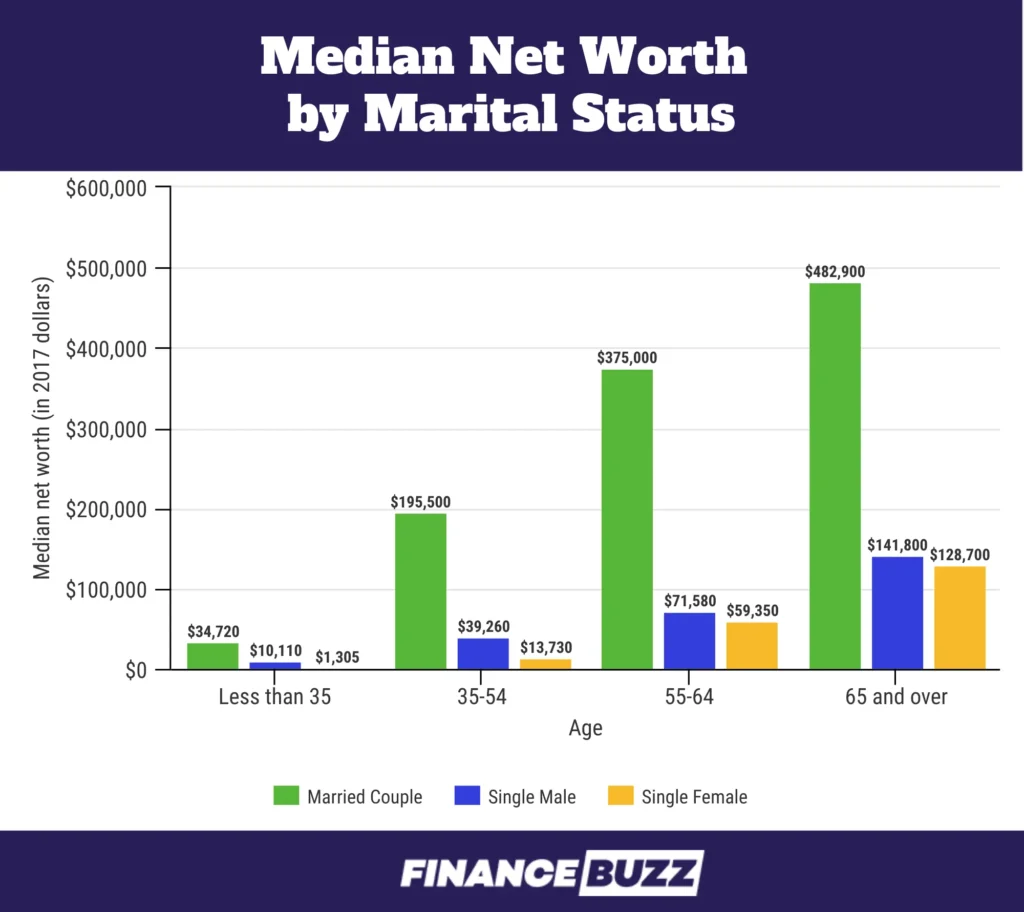

Married couples make more than single people. You may think this sounds obvious, and it does to a certain extent especially when considering dual-income households. The numbers, however, do not support that. With people under the age of 35, a single female has a median net worth of $1,305, and a single male has a median net worth of $10,110. If we assume that the married couple is a heterosexual couple, then their combined net worth should be $11,415. If we assume that the married couple is a homosexual couple comprising of two men, the net worth should be $20,220. If we assume that the married couple is a homosexual couple comprising of two women, the net worth should be $2,610. (Note: These statistics are from the U.S. Census Bureau in 2017 and only two genders are specified.) The median net worth of a married couple, however, does not match any of these numbers. For a married couple (the statistics also include partners) the median net worth is $34,720. Median student loan debt for those married or living with a romantic partner was $10,400 and $7,900, respectively, while single young adults owed $20,000. This shows that one’s marital status is a significant factor in one’s earning potential and debt ratio. This does not mean that you should run out and get married to the first person you see, because family structure also plays a significant role.

Family Structure and Financial Stability

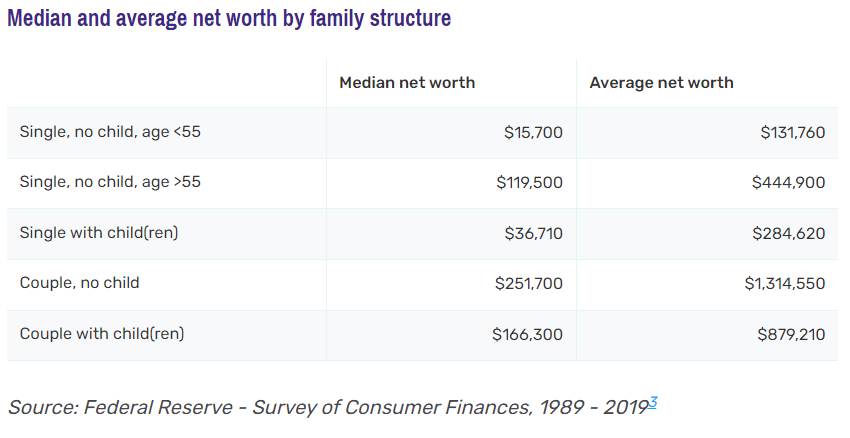

I’m sure it will come as no surprise to anyone that couples without children have a much higher median net worth $251,700 versus $166,300 for couples with children. A single person without children under the age of 55 has a median net worth of $15,700, while a single person without children over the age of 55 has a median net worth of $119,500. Age does not appear to play a factor when the family structure is single with children which has a median net worth of $36,710. Most research on families with children focuses on income levels and distribution, yet researchers have noted net worth impacts children’s well-being more than a family’s income.

In this section, we explored three of the seven primary factors that can contribute to higher income and to net worth. Income is not the only factor in determining net worth. If you make 400,000 dollars and spend it all on beanie babies, you will, most likely, not have a high net worth because you have not increased your assets but have just depleted your resources. Keep an eye out for part two where we will explore four more factors that affect your financial stability and net worth.

Did any of these numbers surprise you? Let us know in the comments!